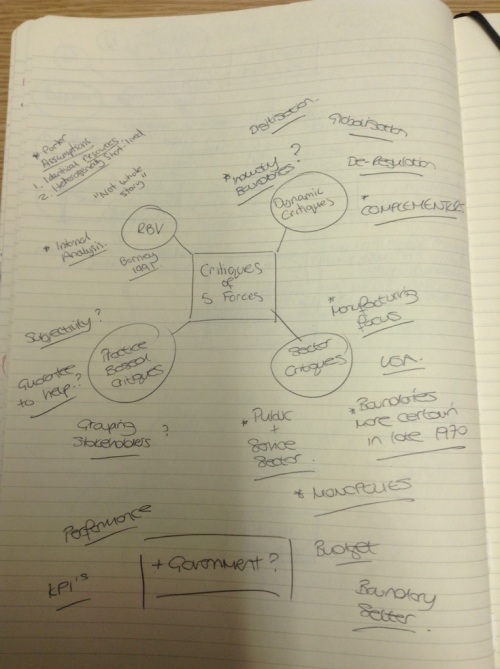

Popular critique of the 5 forces model surfaces 4 categories:

– resource based issues

– industry dynamics issues

– practical issues

– sector issues

This diagram summaries the common issues with porters model and even introduces the possible need of a sixth force – government – for public sector industries.

Key points include:

– an assumption that all organisations have the same access to resources

– that heterogeneity is short lived

– and that there is no inward looking aspect to the model.

– industry dynamics mean that boundaries are often blurred (TV, broadband, telecoms)

– COMPLEMENTERS are considered; laptops existing without software? Cars without fuel?

– does it application in practice guarantee success?

– is it possible to group stakeholders? Can some fall into different groups?

– and the subjectivity associated with its application

– applicability to monopolies such as the public service sector

– boundaries were more stable back in late 1970’s

The idea of GOVERNMENT being a sixth force is also raised – based on its ability to influence profitability through legislation, regulation….. And it’s strong financial power.

I’m not entirely convinced with all of these critiques – I’ve certainly experienced the sector issues and the blurring of boundaries. But I do think the subjectivity argument is poor, can’t you say that about stakeholder analysis, force field analysis……. Blah, blah (losing the will here!). I can also relate to having stakeholders in more than one group – the public supply the people commodity for is and are also a buyer of our product.

But when it comes to a sixth force I feel a little different. I think government influence falls into the wider macro environmental analysis of an industry – look at the ‘L’ from PESTLE for an example. But I understand where the critique comes from. Perhaps it might be better to have a seventh, eighth, ninth…. Force? You have to stop somewhere eh!

Having read a little about Porters responses to these critiques – I initially feel that responses are week. He argues that these additional forces are factors not forces, and that they should be viewed in terms of how they affect the five forces and the potential for profitability. The nub if the problem for me is what defines a force compared to a factor?.

In his responses he only presents what appear to be his own thoughts and here is only subjective evidence (in the form of his examples to explain things) rather than hard facts. For example – and to paraphrase – governments cannot affect profitability for better or worse, is a pretty loose argument. If they create legislation for smart energy monitors in every household energy uses age will probably drop and profitability for energy companies will reduce. I’m sure his argument would be that; yes but this creates buyer power and it is that affecting profitability. It all seems a bit subjective again doesn’t it?

Anyway, I’m done with this for now. Seems like I’ve been reading it for weeks now. However, I’m sure I’ll be glad when it comes to my assignment and the exam.

Miller Out.