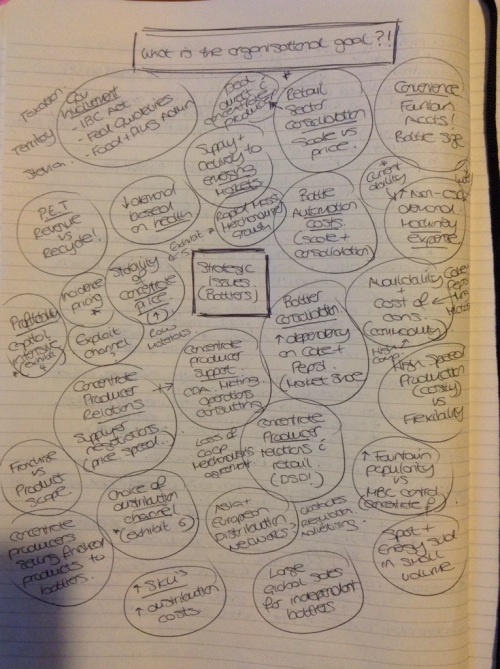

Here’s my analysis of the US CSD Industry – done on my train commute to London today. I still need to consolidate these points and out them into an applied diagram.

But to help with my learning and to capture it all now, I would summarise it like this:

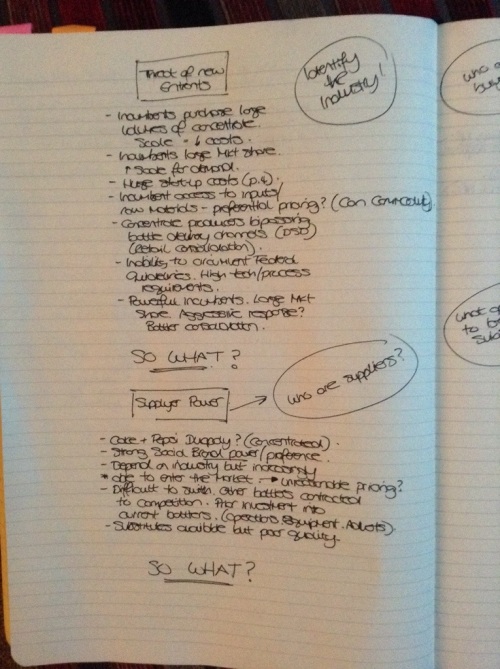

Threat of new entrants is low due to the power of current incumbents, it’s pretty much a duopoly (Doctor a Pepper Snapple Group excluded) with Cola and Pepsi, and the scale economies they have are just huge. They’re also able to bargain with price due to the volume of sales they make to customers. The start up costs are massive – 100’s of million dollars! The recent trend (2010 case study) suggests that customers are preferring to approach concentrate manufacturers directly – this negates a need for bottler direct store delivery (dsd) and cuts costs for customers, and as cola and Pepsi are consolidating their Bottlers again it seems as thought they are integrating forward from concentration production to bottling also. There are significant federal guidelines that cannot be bypassed, and to meet these requires considerable cost for machinery and equipment. And you can bet your bottom dollar that incumbents will aggressively respond to any new entrants and simply swallow them up due their power. New Entrants Not Likely – a good thing.

Supplier Power is a huge force. The concentrate producers (ie Cola and Pepsi) hold most of the cards. Particularly when it comes to brand power and alternatives that don’t really appeal to the consumer. They do depend on Bottlers but consolidating their Bottlers increasingly means that this may not always be the case. For those Bottlers left they may set unreasonable prices for their concentrate – pushing them out of the market. It would be difficult for suppliers to switch Bottlers. Most others are taken up by the opposition and contractual restrictions mean that those Bottlers cannot push out rival products. Also, large amounts of investment with current Bottlers would mean wasted resources in areas like operations improvement, marketing and advertising).

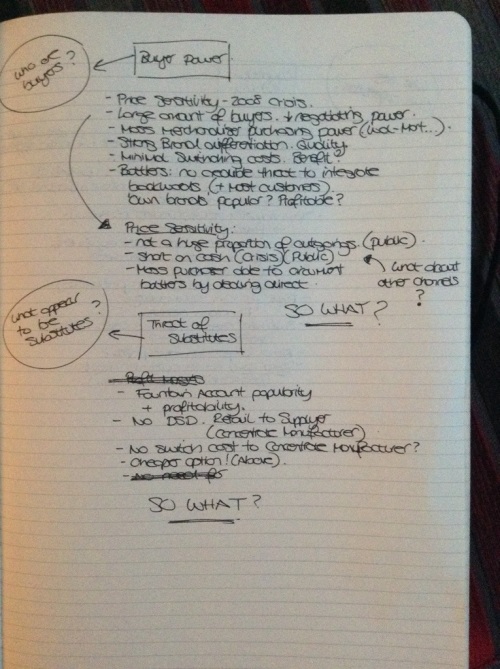

Buyer Power is a bit of a mixed bag. The financial crisis in 2008 has made businesses and consumers more conscious of their expenditure. However, a large amount of buyers means that they don’t necessarily have a lot of negotiating power. The exception to this of course are supermarkets and mass merchandisers who benefit from reduced costs due to volume of purchases. Minimal switching costs increase their power. But there is no credible threat to purchasers integrating backwards and producing their own bottles due to the issues discussed in the new entrants section above.

Threat of Substitute is reasonable. The increasing popularity of ‘fountain’ (pump dispenser) accounts means that bottling is threatened. Also, the alternative to DSD is to go straight to the concentrate manufacturer, a trend already starting to appear. Why pay a middleman when you can cut cost by going straight to the source and purchase in high volume at low cost! I doubt there are many switching costs for the concentrate manufacturer there, they already bottle their own stuff anyway!

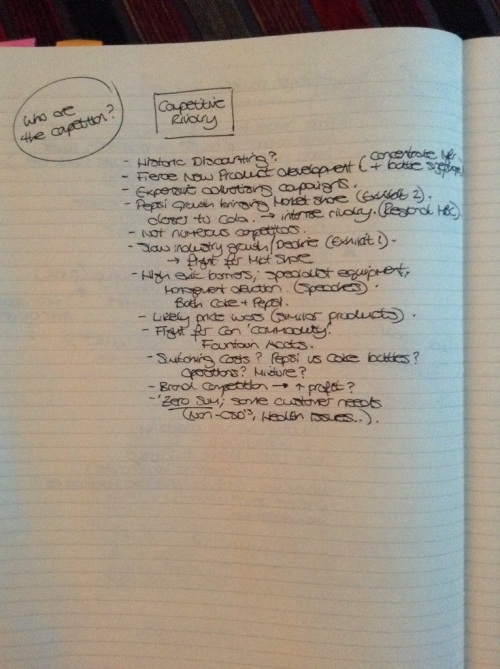

So what about Competitive Rivalry? Well there’s historic discounting wars, fierce new product development (bottle size, shape, new CSD and Non-CSD products….), expensive marketing and advertising campaigns, an increasingly even share of the market (as Pepsi closes in on Cola), slow industry growth (indeed decline) leading to fights for market share, high exit barriers in the form of specialist equipment costs, and strong management commitment (seen in Cola and Pepsi’s AGM speech extracts), similar products increase the likelihood of price wars, competition for ‘cans’ as a commodity? – and profitable ‘fountain accounts’. It starts to add up to a zero-sum game really – where if one player benefits the other loses, and that’s not very attractive now is it.

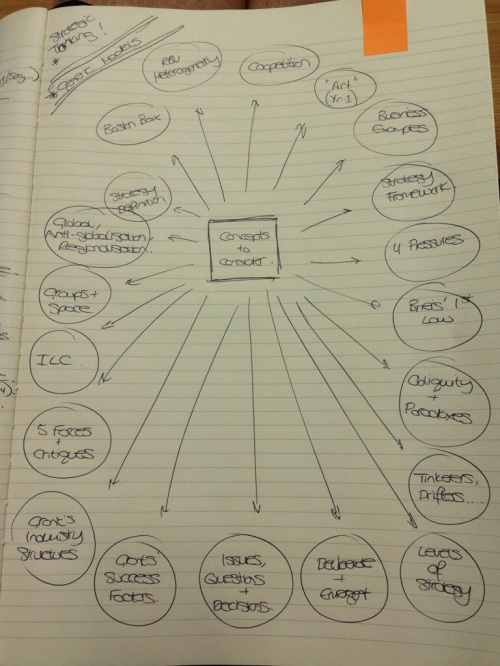

So, a few more things to produce:

– make sure to confirm the industry before cracking on

– identify the stakeholders (suppliers, buyers) with some stakeholder mapping tools

– tie down the possible substitutes

– and tie down exactly who the competition are.

Got to be a framework for that somewhere eh – best dig out the memory banks or go back to my year 1 notes 🙂